Deepak Nitrite Ltd- Q3FY20 Analysis

- Shekhar Yadav

- Feb 11, 2020

- 5 min read

Updated: Jul 6, 2021

Deepak Nitrite Ltd came out with another spectacular set of numbers. I last covered the company’s performance analyzing the Q1Fy20’s number and thought it has reached its peak but the company is still outperforming its previous best. Let me try to explain what is going on in the blog ” Deepak Nitrite Ltd- Q3FY20 Analysis “.

Deepak Nitrite Ltd- Q3FY20 Financial Analysis

Deepak Nitrite Ltd operates in 3 business verticals which are Basic Chemicals(BC), Fine & Specialty Chemicals(FSC) and Performance products(PP). You can read more about them here: Link1

Whereas the only subsidiary ‘Deepak Phenolics Ltd’ manufacture Phenol & Acetone. Read here: Link2

The company derives 50% of revenue from basic or bulk chemicals and 50% from derived products. Derived or downstream products fetches higher margins.

Chemicals business in general is marred with lot of volatility in terms of prices, depending on demand-supply scenario. Deepak Nitrite Ltd is trying to reduce the volatility by being the lowest cost producer as well as making more of value added products.

Deepak Nitrite Ltd- Q3FY20 Financial Analysis PRODUCTS

Let me talk about each product segment:

1. Basic Chemicals:

It finds application in dyes and pigments and is dependent on crude oil prices. This segment has consistently improved its performance owning to the management’s effort to bring in operating efficiency.

2. FSC:

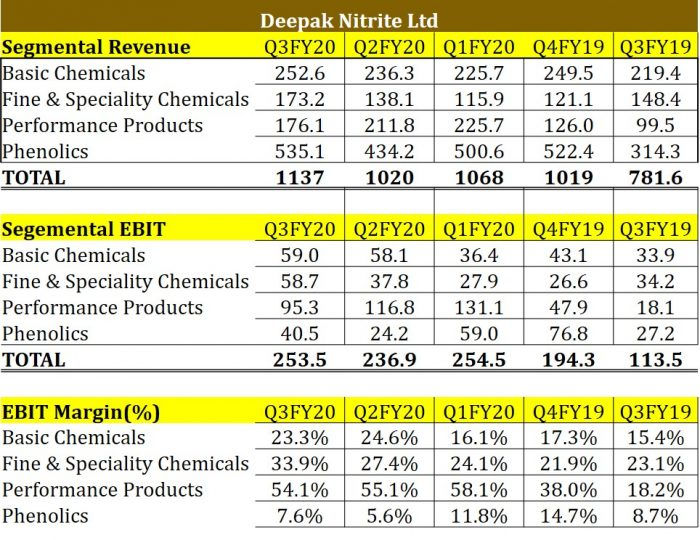

The products in this segment is manufactured based on customization request and hence have much higher margins. There was substantial jump in the EBIT margin for this segment(Q3FY20 EBIT margin at 33.9% — Fig 2) but the management refused to give the specific reason for the improvement.

3. PP:

The product sold under this segment include DASDA & OBA (Fig 1). OBA enhances the appearances of the material on which it is used thus giving it a whitening appearances. Deepak Nitrite Ltd is the only company in the world to be fully integrated manufacturer of OBA.

If you look at the EBIT margin of this segment (Fig 2), it stands at a mind blowing level of 55%. Again this is derived by demand-supply mismatch. The management has time and again cautioned that such high margin is not sustainable for long-term. Based on my experience of tracking the company for quite a while, I can say that the management is aggressive but cautiously performance oriented. It is expected that the margins to correct to some level but remain at a much elevated level from the earlier prices.

The demand-supply mismatch is created because of the world’s largest plant of OBA being closed in China for last 1-1.5 year due to environmental issues. Don’t know when it will reopen but I am sure others might also be trying to fill the supply gap.

Deepak Phenolics Ltd:(Wholly owned Subsidiary)

Phenolics:

Phenol find application in infrastructure products whereas Acetone is used as a solvent for pharmaceuticals. The manufacturing of both the products are meant to substitute the import of both these products in India. There has been drop in prices of these 2 commodity products as is visible in the margins. Phenol is sold at spot prices, there is no long term contract available. So the revenue is totally dependent on the prevalent rate of Phenol in the market.

To dampen volatility of phenol and acetone prices, the company plans to manufacture downstream products to cater to import substitution demand. As of now, the work is ongoing for Acetone derivative called as IPA(Iso Propyl Alcohol) which will consumer 25-30% of total acetone produced. This will not only lead to higher revenue due to better value product as well as higher margins. The production is expected to start from Q1FY21.

Deepak Phenolics Ltd which was commissioned in Nov 2018 became profitable first time in Q3FY20 with a profit of 15 cr. To be honest, it is quite a quick turnaround time despite the unfavorable demand-supply situation globally and acute slowdown restricted to Indian economy.

Fig1: OBA Manufacturing process

Deepak Nitrite Ltd- Q3FY20 Analysis

Deepak Nitrite Ltd- Q3FY20 Financial Analysis

Fig 2: Segmental Performance-Deepak Nitrite Ltd- Q3FY20 Analysis

The company as a whole is operating in 4 product verticals, each having different demand-supply equation. If one segment doesn’t do well, the margins are compensated by the other ones. In the past one year, the the higher margins are supported majorly by Performance products. The management have been putting in lot of efforts to minimize the price volatility impact of chemicals on its end performance be it by squeezing cost at every possible level as well as move towards more value added products.

Deepak Nitrite Ltd- Q3FY20 Analysis

Deepak Nitrite Ltd- Q3FY20 Analysis

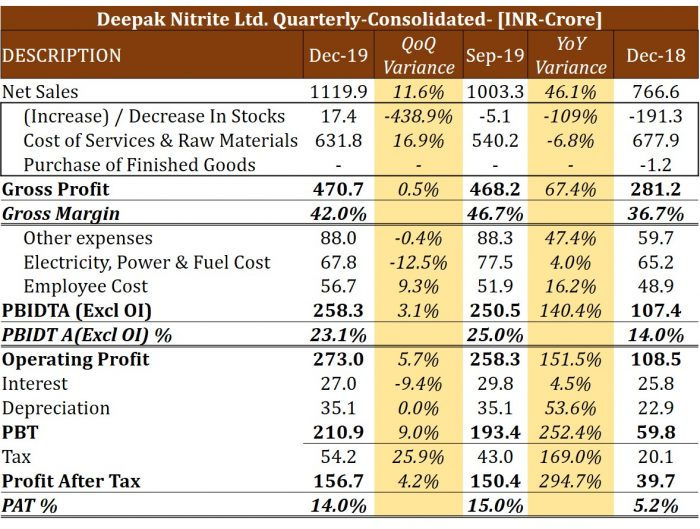

Fig 3: Deepak Nitrite Ltd- Q3FY20 FinancialAnalysis

As you can observe in Fig 3, there has been massive 46% jump in revenue YoY and 11.6% jump in revenues on a QoQ basis. The growth in revenue has slowed down due to higher capacity utilization. The gross margin declined on a QoQ basis mainly due to 17% drop in revenue of highest margin product(PP) (I could not find out the reason for drop in revenue).

There was also higher tax outgo. Other than that all number are more or less in line.

Deepak Nitrite Ltd- Q3FY20 Financial Analysis

Management Commentary

China, which enjoys a dominant position in the market, has been deemphasizing manufacturing of chemicals and high complexity products. Further, global customers are also seeking to establish operations in alternate markets other than China for which India is better placed. Uncertainties caused by the corona virus are exacerbating the concerns around China. This is a tailwind for the speciality chemical industry and Deepak Nitrite is well placed and endeavours to continue to build upon its success in recent years. DNL is secure on the raw materials front, since it sources most of its raw materials locally and has a well-integrated facility. It has also undertaken positions to ensure that supply of imported raw materials are covered for the current quarter causing no disturbance to operations as a result of the developments in China.

Deepak Nitrite Ltd- Q3FY20 Analysis

The company has been benefitting from the global chemical industry development. Customer who were earlier totally dependent on China are looking for alternative sources for procurement. With the kind of reputation that Deepak Nitrite has, it wants to capitalize on the opportunity. Always doing some capital expenditure to expand capacity, also have acquired 125 acres land in DAhej, Gujarat for expansion.

Coming to the products, since prices for most of the product is determined by global demand-supply situation. As of now things are going too well for the performance product as well as all the other product segments are also firing. When things are going too good, there always remains the higher probability of things going the other way round.

Also, currently almost all the product segment is running at full capacity. So, the next level of growth most likely will be coming from debottlenecking and minor expansions.

Further reading:

Comments