Jubilant Ingrevia Ltd came out with its result on 19th of Oct with highest ever quarterly revenue of ₹1223cr. While the revenue growth was robust(56% YoY & 7% QoQ), the bottom line was hit by the rising raw material cost, leading to a sharp fall in share price by almost 15%.

To counter the increase in raw material cost(Increased by 24.6%), the product sales price could increase only by 6.9%, leading to decline in gross margins.

I also have written a detailed blog on Jubilant Ingrevia, which you can read below:

Financial Performance: Jubilant Ingrevia Ltd - Q2FY22 Analysis

Coming back to the quarterly result, as you can see in the image above, while the Year on Year(YoY) EBITDA margin fell by 1.4%, the Quarter on Quarter(QoQ) the margin fall was a massive 8.6% leading to the share price plunge.

The key culprit was the life sciences biz where the margin dropped from 27.3% to 13.8%. I have explained that below.

The good thing about this quarter was the debt reduction by ₹193cr because of which the interest outgo stood at just ₹7cr compared to ₹13cr in the last quarter. Gross debt as of 31st Sept'21 stood at ₹263cr compared to ₹457cr last year.

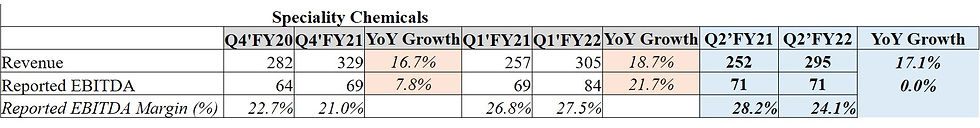

Now, let me take you through Jubilant Ingrevia's 3 segmental performance:

Specialty Chemicals: Contributed to 25% of total Revenue in Q2FY22

While the YoY sales increased by 17%, the bottom-line was hit by higher raw material cost. End application of agro-chemical and pharma saw good volume growth.

Products in Pipeline: 36

Investment to be made between FY21-FY24: ₹550cr

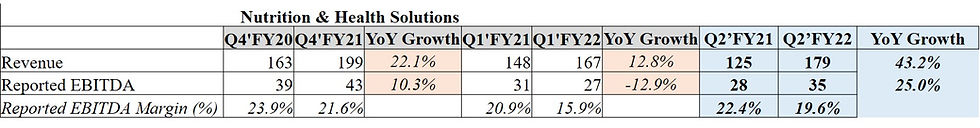

2. Nutrition & Health Solution: Contributed to 15% of total Revenue in Q2FY22

Strong demand for Vitamin D3. Demand for animal nutrition remained strong due to recovery in aquaculture and poultry. Prices of both Niacinamide and Niacin remained at an elevated level.

Company is trying to increase share of specialty premixes from currently selling ingredients, that will lead to better margins.

Products in Pipeline: 18

Investment to be made between FY21-FY24: ₹100cr

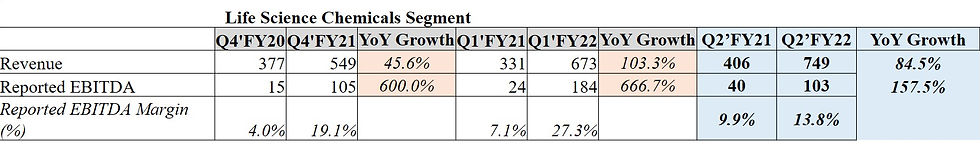

3. Life Sciences Business: Contributed to 60% of total Revenue in Q2FY22.

Life sciences biz consists of the Acetyl chemistry business.

THIS BUSINESS SEGMENT WHICH IS THE MAJORITY CONTRIBUTOR TO THE REVENUE(50-60%) IS HIGHLY DEPENDENT ON ACETIC ACID PRICES.

During Q2FY22, there was sharp correction in Acetic acid prices from ₹160/kg to around the level of ₹80/kg. Whenever there is such fall in commodity prices, it leads to inventory losses as well as sales at an lower price level. And towards the end of the quarter the prices recovered back to ₹160.

According to the Management, ₹80 should be considered to be the normal level of acetic acid prices for tracking future performance.

Acetic Anhydride demand remained strong during the quarter.

Ethyl acetate(the green solvent) demand was slow but recovered towards the later part of the quarter.

Co expects favorable market condition for Acetyls due to disruption in China and Europe, force majeure by key acetyl producers. Most of the acetic acid producers are in China or South East Asia. No new capacities of acetic acid has come up and due to closure of many facilities in China has created favorable demand-supply scenario.

Also, Other than China & India, no one makes acetic anhydride as the technology is not available and also it is not a simple product to manufacture.

Products in Pipeline: 7

Investment to be made between FY21-FY24: ₹250cr

Other Updates:

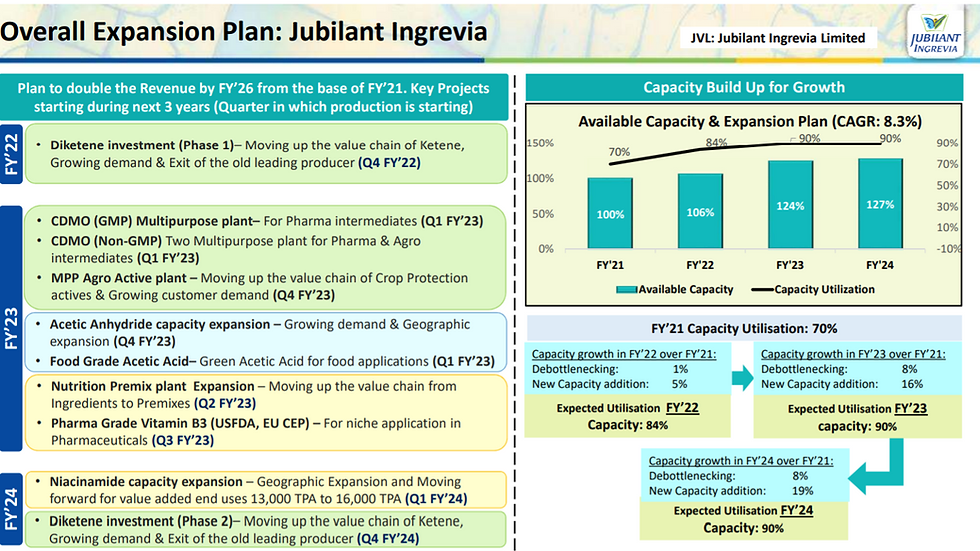

Company's Diketene capacity is expected to come on stream by Q4FY22. The imposition of Anti dumping on one of the Diketene product will help the pricing.

Overall expansion plan:

At full capacity utilization, this CAPEX is expected to generate 2x of revenue.

Company aims to double revenue by FY'26 from the base of FY'21.

Due to supply disruption in China, the demand scenario remains favorable for Indian Chemical industry.

Comentários